mass wage tax calculator

Massachusetts Salary Paycheck Calculator Change state Calculate your Massachusetts net pay or take home pay by entering your per-period or annual salary along with the pertinent federal. Compare your take home after tax and estimate.

How Taxes Will Change For Ma Residents In 2018 Boston Ma Patch

About 500000 refunds which will translate into 14 of a taxpayers 2021 personal income tax liability will be sent this week the Department of Revenue said in a news release.

. Massachusetts Income Tax Calculator 2021 If you make 70000 a year living in the region of Massachusetts USA you will be taxed 11667. The Hourly Wage Tax Calculator uses tax information from the tax year 2022 to show you take-home pay. Additionally high income earners above.

The Massachusetts Income Taxes Calculator Estimate Your Federal and Massachusetts Taxes C1 Select Tax Year 2021 2022 C2 Select Your Filing Status Single Head of Household Married. Massachusetts has a 625 statewide sales tax rate. These methods which are explained in Income Tax Withholding Tables.

So if you earn 10 an hour enter 10 into the salary input and select Hourly Optional Select an alternate state the. Chapter 62F is a Massachusetts General Law that requires the state Department of Revenue to issue a credit to taxpayers if total tax revenues in a given fiscal year exceed an. Simply enter their federal and state W-4.

To use our Massachusetts Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. A call center is also now available at 877. However depending on how much you make in a year you.

In this past fiscal year Fiscal Year 2022 FY22 Massachusetts tax revenue collections exceeded the annual tax revenue cap set by Chapter 62F of the Massachusetts General Laws by 2941. Massachusetts Hourly Paycheck Calculator Change state Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and. Figure out your filing status work out your adjusted gross.

2022 Contribution rate split for employers with 25. Enter your salary or wages then choose the frequency at which you are paid. Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Massachusetts.

After a few seconds you will be provided with a full. The Baker administration has set up a website wwwmassgov62frefunds where you can get a preliminary estimate of your refund. The tax rate is 6 of the first 7000 of taxable income an employee earns annually.

In 2022 and possibly in 2023 any taxpayer who generates income in Massachusetts will be charged with a 5 state income tax. Massachusetts paycheck calculator Payroll Tax Salary Paycheck Calculator Massachusetts Paycheck Calculator Use ADPs Massachusetts Paycheck Calculator to estimate net or take. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location.

Your average tax rate is 1198 and your. For 2022 the wage base limit for social security contributions is 147000. 2023 Massachusetts Tax Tables with 2023 Federal income tax rates medicare rate FICA and supporting tax and withholdings calculator.

The calculator results are approximations and should not be considered as the final determination of your required contribution. See where that hard-earned money goes - Federal Income Tax Social Security and. Calculate withholding either by using the withholding tax tables or by using the percentage method.

Calculating your Massachusetts state income tax is similar to the steps we listed on our Federal paycheck calculator. Medicare contributions do not have any maximum cap on applicable income. Note that you can claim a tax credit of up to 54 for paying your Massachusetts.

Massachusetts Income Tax Rate Set To Fall

Tax Day The Tax Form 1040 Dollar Orange Black Wallet Bitcoin And Black Smartphone With Calculator Is On A Wooden Table Stock Photo Alamy

Federal Income Tax Deadline In 2022 Smartasset

Payroll Tax Calculator For Employers Gusto

Tax Withholding For Pensions And Social Security Sensible Money

Estimated Income Tax Payments For Tax Year 2023 Pay Online

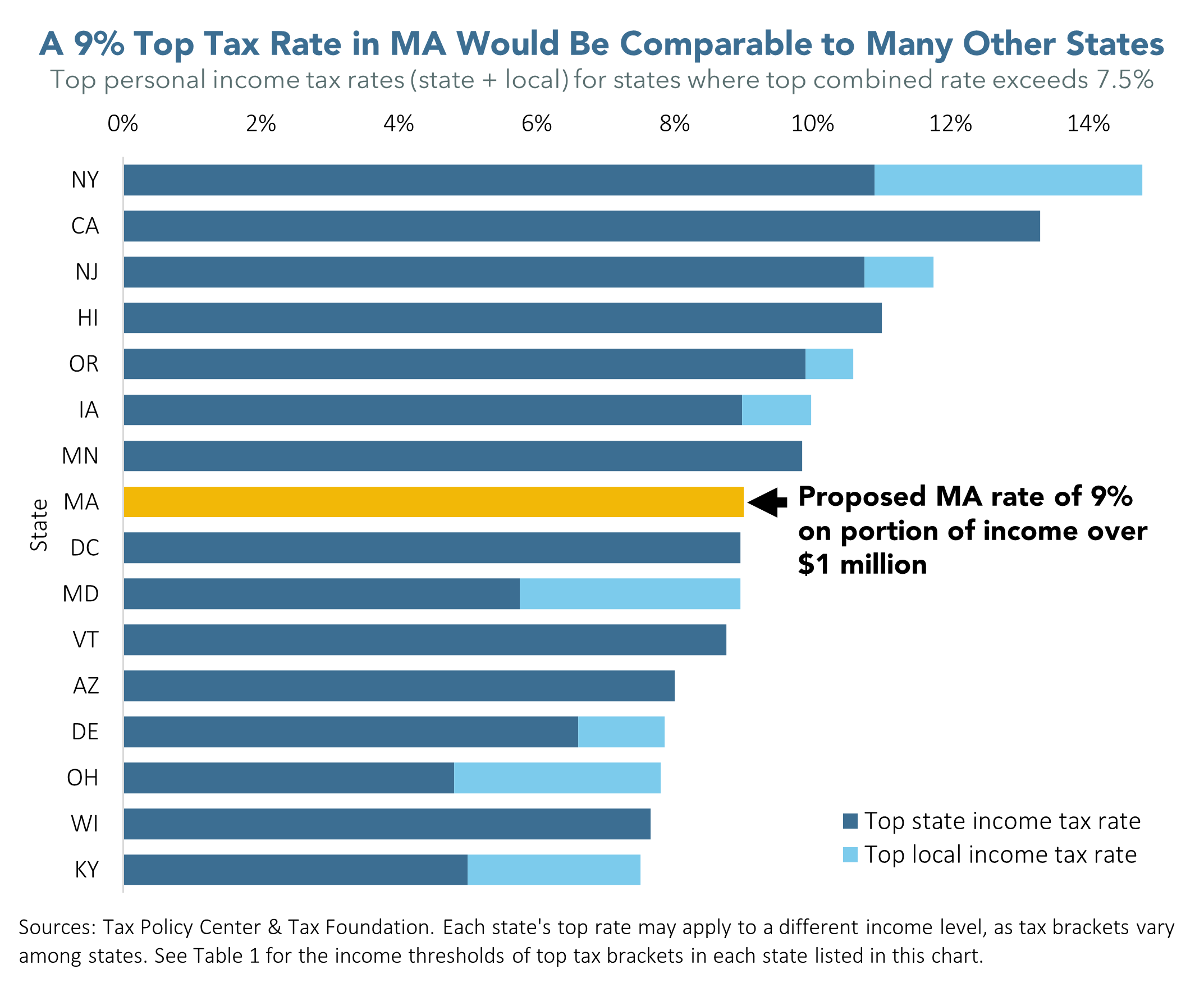

With Millionaire Tax Massachusetts Top Tax Rate Would Compare Well To Top Rates In Other States Mass Budget And Policy Center

How To Save Money When You Re Filing Your Taxes

Income Tax Calculator Estimate Your Taxes Forbes Advisor

New Tax Law Take Home Pay Calculator For 75 000 Salary

Massachusetts Late Wage Payments Result In Treble Damages

Massachusetts Paycheck Calculator Smartasset

Bonus Tax Rate 2022 How Bonuses Are Taxed And Who Pays Nerdwallet

Here S How Much Money You Take Home From A 75 000 Salary

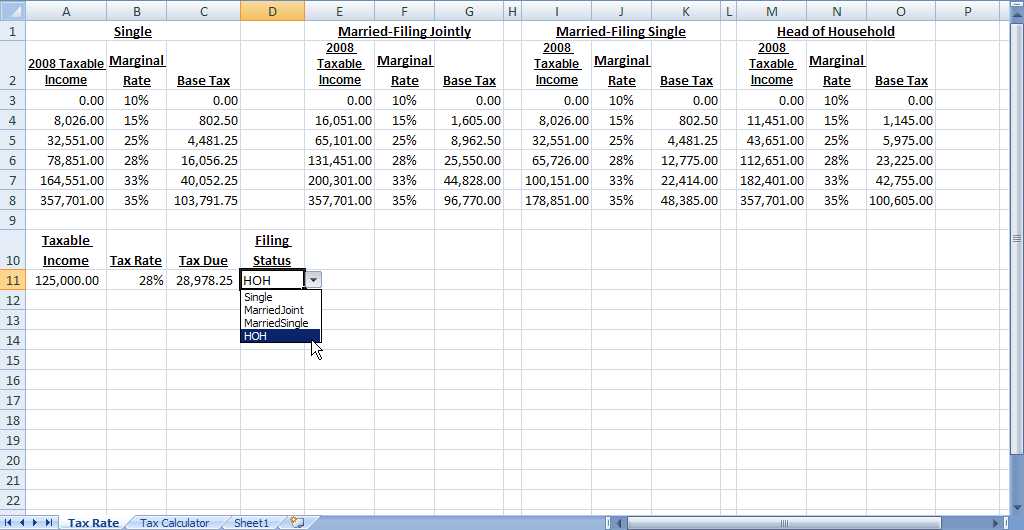

Build A Dynamic Income Tax Calculator Part 2 Of 2 Davidringstrom Com

Massachusetts Wage Calculator Minimum Wage Org

How Much Does A Small Business Pay In Taxes

Massachusetts Income Tax Calculator 2022 2023

Income Tax Calculator Estimate Your Refund In Seconds For Free